Evaluating Sales Performance Through The Lens of Your Compensation Plan

As the song goes, we’re about to enter “The Most Wonderful Time of the Year”. Too much food, football, and family. As sales consultants, it’s also the time of year that our phone rings… a lot.

While the industry or leader may be different, the underlying (and often dire) statement is the same: My sales team isn’t hitting the numbers. The compensation plan needs to be ‘tweaked’ for next year. Typical self-diagnoses include:

“We are not paying our top performers enough.”

“This salesperson has worked really hard, but she isn’t being rewarded for that work.”

"Our comp measures don’t align to what our reps are doing.”

“Our reps can’t achieve their target pay because our commissions are too low (or quotas are too high).”

Here’s the truth. In our decades of experience, it’s NEVER JUST compensation that leads to sub optimal performance. Yet, it’s often easiest to point fingers at the incentive plan: it’s tangible, quantifiable, and usually ‘owned’ by someone outside of sales. And there’s always a lot of passion around the topic since it directly impacts the wallet.

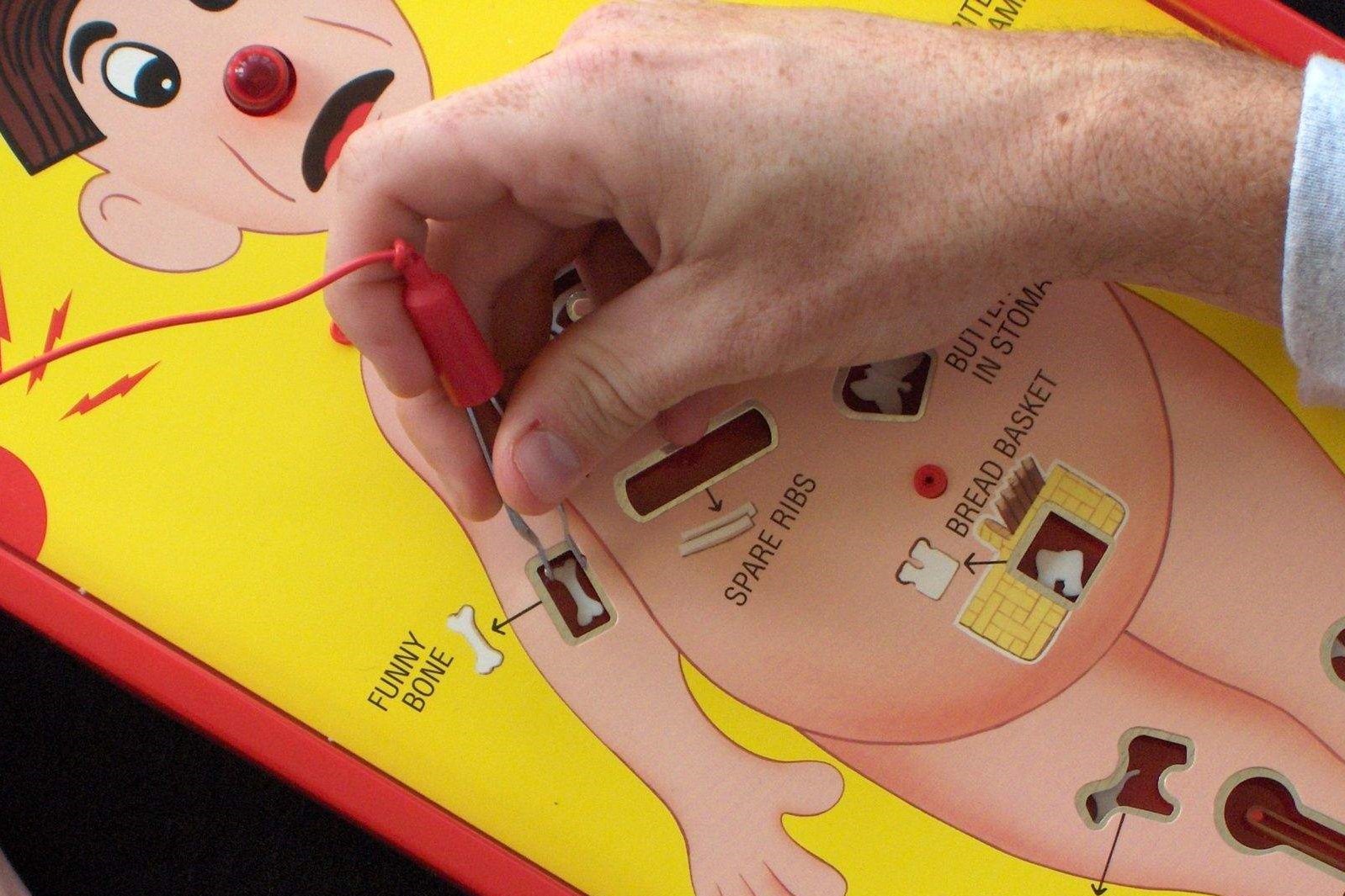

Do you remember the childhood game “Operation”? The goal was to remove the Adam’s Apple or Funny Bone without the patient’s nose turning red and buzzing obnoxiously. How many times were you able to go in and pull out all of the odd parts without triggering the buzzer? To win the game, you must extract not just one, but all the parts without touching the sides.

Sales compensation is a lot like the game of Operation. Leaders often look at their issues through the lens of your compensation plan. It’s typically the first thing to be diagnosed, but very rarely is it the single cause of problems. Just like the game, you can just pull out one part without the loud buzzing. You need to diagnose all of the parts, working to address the entire system.

Let’s look back at those quotes from earlier and think about broader diagnosis questions. What additional probing questions can help determine the true underlying cause?

“We aren’t paying our top performers enough.”

- What defines a top performer?

- Is it their performance-to-goal or their internal reputation?

- Are they really your ‘top’ performers’?

- What is ‘enough’ – Compared to peers? Market? Competition?

- If this person left tomorrow, would business still come in?

“This salesperson has worked really hard, but she isn’t being rewarded for that work.”

- What defines working really hard?

- Is that person working hard to support your strategic goals and quota?

- If the person is underachieving their goals, why is the reason?

- Is the person in the right role?

“Our compensation measures don’t align to what our reps are doing.”

- How do your reps spend the majority of their time?

- Are these activities aligned with their role/focus?

- What are the non-selling activities that are filling up their day?

- Do the compensation plan measures align with the sales strategy?

“Our reps aren't able to achieve their target pay because our commissions are too low (or quotas are too high).”

- Should the reps be achieving their target pay based on their performance?

- How are the targets determined, and by whom?

- Is commission (or quota-based) the right mechanic for your compensation plan?

Sometimes you can uncover the underlying cause in a few interviews or with a quick analysis. Other times, it may take an in-depth assessment that includes ride-alongs, team surveys, customer interviews, and so on. Most importantly, don’t forget “BS SNIFF TEST” to determine what’s really going on beyond compensation.

As you embark on a “compensation” effort, look beyond the pay and performance data, T&Cs, and plan documents. This will help you more accurately diagnose what is and isn’t working. Some common diagnoses uncovered that go beyond compensation include:

Diagnosis #1: Strategy Misalignment

Definition: Leadership’s sales strategy does not align with where the field focuses and gets compensated.

Underlying Comp-Like Symptoms: Under-performance to comp plan measures due to miscommunication or disconnect between the sales strategy and field actions.

Real-Life Example: Leadership focus is on margin, but sales team does not have influence over pricing.

Treatment: Strong communication and definition of the strategy from top-down. Ensure all resources, processes, and enablement tools (including compensation) align to the strategy.

Diagnosis #2: Coverage/Role Definition

Definition: Misallocation of resources to accounts or territories. Use of so-called ‘hybrid’ roles that are not well defined. This leads to confusion in the field around priorities, focus, and time management.

Underlying Comp-Like Symptoms: Under-performance to goals/targets due to too much time spent on non-selling activities.

Real-Life Example: An outside sales rep is no longer responsible for quoting/proposals but still spends time in this area because of poor role clarity. Fuzzy understanding of new internal pricing team further muddies the water.

Treatment: Clear definition of the coverage model and roles (inside/outside, hunter/farmer/support, etc.). Clarify the lines of responsibility, including the optimal sales channels, who ‘owns’ each piece of the sales process, and the handoff points.

Diagnosis #3: Talent

Definition: Lack of will and/or skill for specific sales roles. Generally, occurs due to Diagnosis #2 or when assumptions are made versus thoughtful assessments.

Underlying Comp-Like Symptoms: Failure to attain goals and KPIs due to lack of skill/will to achieve those goals.

Real-Life Example 1: Moving a rep who has performed strongly in a big market to a smaller, underperforming market, and then expecting the same results

Real-Life Example 2: Transitioning from a hybrid to hunter/farmer model and assuming all reps can and want to hunt (or farm).

Treatment: Once the ‘boxes’ are laid out in Diagnosis #2, conduct various assessments (360-degree, personality, competency) to determine the required skills for success in each role. Then evaluate each individual to see if performance and potential aligns with the required skills. Do NOT assume or settle.

Diagnosis #4: Quota Allocation

Definition: Less than 50% of the organization achieving their performance goals and/or inability to allocate goals based on individual skill/market/account potential.

Underlying Comp-Like Symptoms: Under-performance to goal resulting in payouts below target (and usually disgruntled employees). Also, lack of motivation to perform for full year due to inability to hit goals.

Real-Life Example: A rep has a strong prior year based on selling newly launched products to existing accounts. Rep is ‘rewarded’ with higher goal for these same accounts despite limited white space.

Treatment: Comp and quota allocation is ‘chicken and the egg’ – a well-designed plan is useless if the goals are not attainable or realistic. Gain top-down and bottom-up input on goals based on the budget, market/account potential, and other industry growth factors.

A Scalpel or a Full Diagnosis?

The right sales compensation design plan can drive major sales productivity. But the greatest performance lift means looking at the entire sales system. Beyond the items above, there are many other non-compensation diagnoses that can lead to under performance. These include lack of sales process or sales tools, insufficient sales enablement (messaging, training, other field support), or poor coaching. Before you pull out your comp scalpel, make sure you ask the probing questions to go beyond the visible symptoms.

Contact us to schedule quick health check of your sales system before the new year starts. We’d love to share practical strategies for driving your best sales productivity.

About The Author

.png?height=120&name=Carrie%20Photo%20(3).png) Carrie is an experienced consultant specializing in sales analytics, organizational design, and sales process optimization. She is the co-author of The Sales Compensation Handbook as well as numerous sales research studies.

Carrie is an experienced consultant specializing in sales analytics, organizational design, and sales process optimization. She is the co-author of The Sales Compensation Handbook as well as numerous sales research studies.